semiconductor is a very capital intensive & very competitive industries to be in.

At Eastspring Investments. We had position companies like this to be include into our portfolio.

Originally tweeted by adezeno S.O (@adezeno_s_o) on July 6, 2021.

——————————————————————————————————————————————

source:

- The past 20 years we see [[mobile phone]] evolved from a telecommunications 📡 device with basic function such as ^^sms^^ & ^^call^^ into a personal information platform.

- What’s behind every [[smart phone]] today is the little thing call [[semiconductor]] or ^^integrated Circuit^^ (IC)

- This is like the “Brain” that run your [[smart phone]]

- [[semiconductor]] are manufactured in a foundry know as Fabrication plan or (Fab)

- [[Taiwan]], [[South Korea]] & [[China]] account for 90% of Global capacity

- The current Valuation for [[semiconductor]] foundry market is USD 42 Billion -> expected to reached USD 62 Billion by 2026

- [[Taiwan]] control 80% of the market share for smallest & most efficient chip.

- How much it takes to Run a [[semiconductor]] foundry?

- Today it cost about $3 -4 Billion USD to build a Fab & produce Chip that car maker need.

- And they company need to throw even more money 💸 into R&D to keep up with the latest technology.

- [[Taiwan Semiconductors]] [[$TSMC]] is a world leading [[semiconductor]] foundry.

- They recently announce will invest $100 Billion USD to expand its chip fabrication capacity.

- Currently TSM is already mass producing chip using very advanced ^^Extreme Ultraviolet (EUV)^^ lithography technology

- This technology enable it to make Smaller & Faster Chip at lower cost. 🚀

- Having said that, it’s difficult for newcomer to get into this field and compete with [[Taiwan Semiconductors]] & other season player such as [[samsung technology]]

- Today it cost about $3 -4 Billion USD to build a Fab & produce Chip that car maker need.

- How profitable is [[semiconductor]] industries?

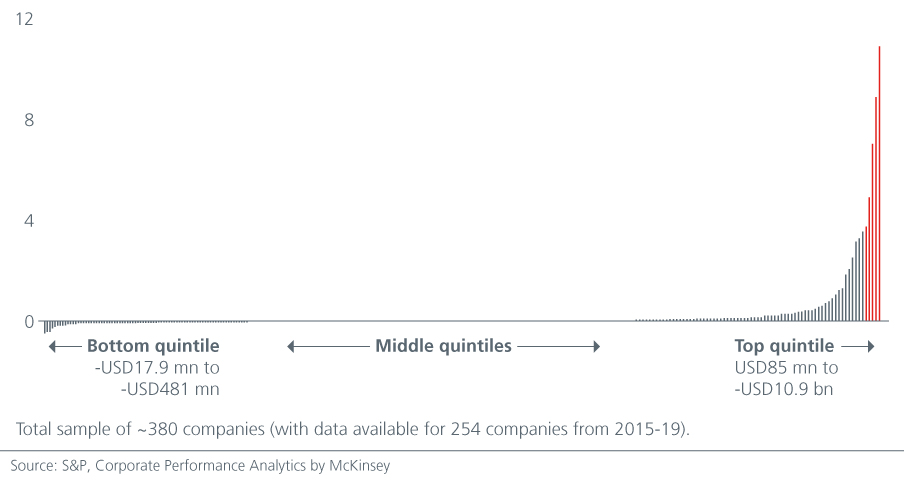

- According to McKinsey, our of 254 [[semiconductor]] companies, the top 5 company have the largest combine annual profit compare with the rest.

- It’s a winner takes all enavironment.

- Trend that Drive the [[semiconductor]] demand.

- The chip shortage experience this year was cause by unexpected high demand for [[electric Vehicle]]

- The other demand also drive by [[5G]], Artificial intelligence [[AI]], & Internet of Thing [[IoT]]

- The Gaming 🥌 sector also contribute the the demand. Games that demand for cutting edge chip for cloud & [[5G]] connectivity, and Virtual Reality [[VR]]

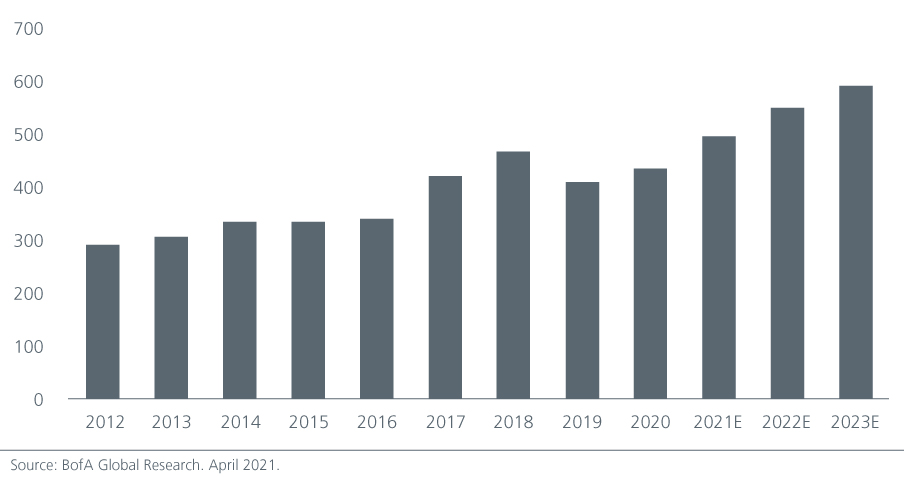

- Sales of [[semiconductor]] chips is expected to grow at a compounded average growth rate (CAGR) of 10.7%

- above Graf shows Global semiconductor sales (USD billions)

- Source: Eastspring Investments.

- Summerize by: http://www.adezenoso.com

- What’s behind every [[smart phone]] today is the little thing call [[semiconductor]] or ^^integrated Circuit^^ (IC)